‘I am in awe of the approach taken today’: Over 150 bankers & campaigners attend Catalysing Bank Climate Action report launch

Jacqueline Lim is Fellowship Programme Manager - responsible for designing and launching the Climate Safe Lending Fellowship in conjunction with the Climate Safe Lending Network and the Finance Innovation Lab. Here, Jacqueline shares her write-up from the launch event for Catalysing Bank Climate Action: Lessons from the inside.

On 29 June 2022, the Climate Safe Lending Network (CSLN) and the Finance Innovation Lab (FIL) were joined by over 150 attendees from across the globe for the launch of our pioneering new report, Catalysing Bank Climate Action: Lessons from the inside. The report features key insights from our inaugural Climate Safe Lending Fellowship 2021/2022.

Attendees had a unique opportunity to hear directly from report co-authors, Lydia Hascott (Head of Intrapreneurship, FIL), Natalie Tucker (Fellowship Manager, FIL), and James Vaccaro (Executive Director, CSLN).

The event gave attendees the opportunity to be inspired by one of our 2021/2022 Fellows, who reflected on their personal experience on the Fellowship programme. They also shared the strategies they successfully deployed to facilitate a network of engaged colleagues to drive climate action across their bank.

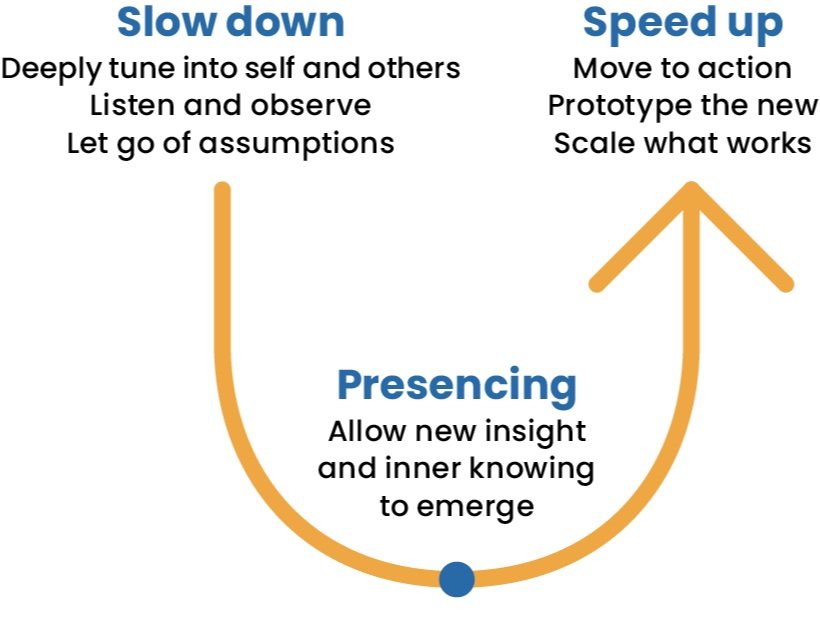

The webinar provided a safe space for bankers and campaigners alike to learn about key barriers and enablers faced by climate intrapreneurs working internally to advance the transition to climate safe lending in their banks. Attendees were also given the opportunity to experience ‘Theory U’ first-hand - one of the key tools that Fellows worked with during the Fellowship.

Theory U - The Presencing Institute

In pausing to reflect on what was surfacing for them about the role they play in bank climate action - regardless of whether they worked inside or outside a bank - attendees shared the following responses:

“From the outside, the most effective thing I can do is support lobbying for regulation.”

“How do I build this into our strategic plan, build allies and educate the bank?”

“Individuals need to go on a ‘purpose journey’ first to build the right mindsets”

“[This is an] opportunity for me to improve at listening empathetically and figuring out personalized ways to communicate why climate work is important”

“How, as a campaigning organization, to scale the number of intrapreneurs at a bank and expand their impact, particularly when a big bank has 50,000+ employees?”

“How do we reconcile the bigger, long-term task of totally transforming banks’ culture with the urgent need for them to make the right decisions on lending to high-carbon industries?”

If you missed the webinar, you can access the webinar recording and slides, along with the report and other resources here. Or find out more about the Climate Safe Lending Fellowship - applications are now open for the next cohort, deadline 26 September.

Apply Now: Applications open for 22/23 Climate Safe Lending Fellowship programme

The ground-breaking six-month leadership development programme for banking professionals advancing the climate agenda within their institutions is back – don’t miss your chance to access unique sector insights, develop new tools, and learn new skills alongside committed, like-minded peers.

In 2021 alone, the world’s 60 largest banks provided more finance to fossil fuels than in 2016 – the year the Paris Climate Agreement was signed. Yet there are passionate and committed individuals working inside banks who envision a banking sector that finances a just and regenerative economy – one that addresses the intersecting ecological and social breakdowns interconnected with the climate crisis. These banking professionals recognise that their institutions and sector require transformation to realise this vision and are working tirelessly to enable this from the inside out. We call them ‘climate intrapreneurs’.

The first ever cohort of the Climate Safe Lending Fellowship was truly pioneering. 23 Fellows from 20 banks based across North America, Europe, Africa, Asia and the Middle East developed the capability to lead change from within their institutions. Holding roles from Vice President to Executive Officer, Fellows also uncovered new insights on what enables banks to transition more rapidly toward financing a just and regenerative future (read more about those insights here).

“The CSL Fellowship was transformative and unlike any professional development experience that I have participated in. When asked to describe the experience, I jokingly called it “group therapy for sustainability professionals”. But in reality, the workshops are designed for introspection, evaluation and the development of new connections, tools and insights about the critical work that we are all doing. I am taking with me a feeling of empowerment, clarity and a true feeling of fellowship with my cohort.”

CSL Fellow 21/22

Today, the Climate Safe Lending Network and the Finance Innovation Lab are delighted to announce that applications are now being accepted for the second cohort of the Fellowship.

The CSL Fellowship is designed to develop the internal talent in banking to embed and advance climate action within their institutions. Fellows will access sector insights and emerging new practice in climate finance. They will leave the programme with new tools, skills and multi-stakeholder networks gained in a pre-competitive, collaborative environment.

The programme is for committed climate advocates who are currently employed by a bank, and are working to accelerate climate action in their institutions. It takes place between December 2022 – May 2023 (6 months), with an average time commitment of up to one day per month. The programme is fully virtual.

To find out more about the programme and apply, click here.

If you would like to hear directly from the Fellowship programme team, join our first Taster Session on Monday 11 July – sign up here.

Case study: ‘Activism’ is not a dirty word

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series. We invited The Sunrise Project, a global campaigning organisation working to hasten the transition from fossil fuels to clean energy, to speak to Fellows on the programme.

Here, Areeba Hamid (Global Finance Programme Director) and Beau O’Sullivan (Senior Communications Officer) share some of their reflections on how climate intrapreneurs and campaigners can accelerate the transition to climate safe banking together.

What did you take away from engaging with intrapreneurs on the Fellowship?

It’s very easy to get lost in the ‘us versus them’ frame, and forget that [bankers] also are human beings with values and have motivations and risk appetites. And all their decisions are based on those factors, like anybody else. So, I think that was quite useful to just break that barrier and speak to the people we are trying to change. It was also quite sobering to hear first-hand that there is still a wide gulf between the level of change that’s needed, and what the Fellows saw as things that can be done by decision-makers internally.

What is The Sunrise Project learning from its work with banks?

“The history of progress is the history of activism in the world”

Following our session with Fellows, we were invited by two Fellows to engage directly with senior leaders in their organisations. Through these conversations, we realised that we have a lot of experience and knowledge that we can impart to those working inside banks, and that these engagements can be very useful. At the same time, there is still a lot of greenwashing in the banking industry – and we play a crucial role in challenging and holding banks accountable. How do we tread that line of being helpful at the same time as holding them accountable? Walking this tightrope is difficult and tense.

Part of our role is to work behind the scenes and support other partners. In our work with media for instance, we help educate journalists about AGM season, how to interpret shareholder resolution results, the types of loopholes in banks’ climate policies, and how to spot good policies announced by banks, etc. Before COP26, we published a short media briefing on how to spot greenwashing by banks which was very successful in framing lots of coverage in the media.

What do you want climate intrapreneurs to know?

A lot of people think that you have no credibility as an activist. This is not true. We have spent hours and hours churning data, learning the Bloomberg terminal, and following the money. And we know how policies with climate risk are developed. Some of the activists we know are the most well-versed people in finance. It’s a mistake to ignore them.

I think that activism is not a dirty word. The history of progress is the history of activism in the world. Activism is about standing up for what you believe in. I’m genuinely interested in hearing about the barriers faced by Sustainability Officers to moving faster and being more ambitious on climate. If banks were more open about barriers and spoke to us, we’d probably be able to find solutions or help in some way. There is also more scope for public policy and government relations teams within banks to step up in their role and act as an activist within. We are keen to work with intrapreneurs to turn up the dial internally – we can do this anonymously, including penning letters to the board or engaging the media.

It’s a leadership challenge. What’s missing are the voices of the leaders. I would love to see leaders of banks break away from the pack. Of course, there are risks with being the first-mover, but that’s what leadership looks like.

Case study: Slowing down in order to speed up

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This Climate Safe Lending Fellow shares how developing their leadership skills is helping them to progress the climate agenda at their bank.

A particular challenge climate intrapreneurs face is difficulty in finding the time and space to do the kind of deep, reflective thinking required to understand complex challenges and develop new solutions amidst the busy, fast-paced world of banking. On the Fellowship, we introduced Otto Sharmer’s Theory U, and the idea of ‘presencing’, which encouraged Fellows to actively make the time to slow down and let new insight emerge in order to be more effective.

One Fellow described how this approach is helping them:

Adapted from Theory U

“In peer coaching yesterday, the topic we worked through was feeling we don’t have capacity to do everything we need to do. I was too embarrassed to propose it, but I was feeling it, so I’m glad someone else did. It’s a massive challenge! Theory U is my biggest takeaway. I usually go straight to action because I feel that’s my only choice. Spending just a minute or two working down the ‘U’ and up the other side is a very powerful mental model for me.

“I now have a ‘U’ on a whiteboard which helps me to slow down – it’s a mental reminder. Anything I need to make a strategic decision on and feel I have no time to work on, I sit down, look at the U, spend some time being present and really think through all the options. I then spend the time at the bottom of the U to let new insight emerge and take fast action from there. Doing that has really helped me to clear out the backlog on some things, and stopped me missing out on other things.

“If we can’t do this, we’ll burn out. I don’t want to do that, I love my job way too much.”

CSL Fellow 21/22

Case study: Building buy-in with the Executive team

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series. This Climate Safe Lending Fellow shares how developing their leadership skills is helping them to progress the climate agenda at their bank.

Business has the power to make change

“A lot has happened during the time I’ve been on the Fellowship – some of these things might have happened anyway, they were in-flight pre-Fellowship, but they wouldn’t have been nearly as successful without the learnings from the Fellowship. I can say that with a great deal of confidence.

“I’ve been able to talk about ESG and climate change for an hour in front of our leadership team – that’s a huge allocation of time with that group of people. A year ago, if I had been given 15 minutes with our CEO I would have hit him with facts and stats and been disappointed with the results. The Fellowship has changed all of that. I had the opportunity to talk to 90 senior people. While I couldn’t completely get away from facts, I focused on emotional cases which was very different for me. I made them feel uncomfortable and it was kind of scary. I told them that business has the power to make change. I used an analogy with cars: they are the leaders who sit behind the steering wheel powered by the motor of business. I asked, “where are you going to take us?” I tried to make them think and understand they are the ones who have the ability to make change.

We are no longer debating that green business is good business.

“We have a centuries-long corporate history; the thought of losing that legacy if we fail to adapt has been a strong motivator.”

“On the heels of the above, we had a project team present a big eight-month project on green business. A series of concrete, discrete and directional recommendations were shared with the Executive team. Our CEO remarked that green business and climate will be the next frontier for us. His leadership in turn gave direction to the rest of our leaders – these are serious, strategic business issues. The biggest challenge now is implementation. But we are no longer debating that green business is good business.

ESG now has a seat at the table

“I think what is most importantly ‘mine to own’, is to bring climate initiatives forth confidently, firmly, unapologetically. Sometimes it feels that we lead with “we know you have a lot going on, but we need to focus on this too.” I’m working on shifting this to, “This is the lens through which we need to view our business, if we fail to do so, we risk losing business”. We have a centuries-long corporate history; the thought of losing that legacy if we fail to adapt has been a strong motivator. What’s different has been my ability to change the way we go about discussing these issues in a direct, more forceful way.

“ESG now has a seat at the leadership table. I’m pushing for us to go beyond green and sustainability, getting to the core of my Critical Shift which focuses on a just, equitable and sustainable approach to business. If I hadn’t taken the time to think about my Critical Shift, or if I’d backed off on the loftiness of it, we wouldn’t be in the position right now to propose this approach at the bank. Hopefully, we are on the verge of some transformative transitions in our organisation, and that is really quite exciting.”

Insight: What kind of banking system is fit for a just and regenerative economy?

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This excerpt from the report explores what kind of a banking system is fit for a just and regenerative economy. To read in full, download the report using the button at the bottom of the page.

People are planet

Many in the Western world are just now remembering what indigenous cultures have known all along – that people are planet. The problem is (particularly in Western culture) we’ve developed an assumption of ourselves as separate from nature, and have structured societies and economies accordingly. This mindset has led us to shortsightedly use our creative human faculties to serve our own species at the expense of the living and non-living world we depend on to sustain us.

If we can agree that, at its most fundamental, a healthy planetary ecosystem that can sustain life indefinitely is necessary for human existence; and if we can agree that individuals and communities meeting their own needs ultimately benefits our ability to meet our own – then we can begin to explore why we have banks and what we need them to do.

Why do we have banks?

Today, we can identify five immediate functions served by the banking system: creating money, channelling money, looking after other people’s money, sharing risk, and maintaining transaction and settlement systems.

But in the end, what do we need these functions for? Ultimately, banking as a system should create, deploy and facilitate the use of money for the purpose of enabling us to meet our needs as individuals, communities and societies. The banking system should be judged not only on how efficient it is at turning money into more money, but also on how well it plays its unique part in enabling a thriving planetary ecosystem and the human societies within it.

How well are banks meeting this purpose?

Zooming in on the challenge of human-induced climate breakdown, it is clear that banks on the whole are not delivering on this ultimate purpose. The finance that a bank makes available determines the kinds of activities that take place in our economies. Despite a wave of net-zero commitments from banks, their financing for carbon emitting activities has grown over the past five years: In 2021 alone, the world’s 60 largest private sector banks provided $742 billion in finance to fossil fuels.

Yet carbon emissions do not sit in isolation from other ways the planetary ecosystem (human and non-human) is in trouble – and bank finance influences them all. Focusing only on net-zero emissions is short-sighted. We and our Fellows see what is commonly named the ‘climate agenda’ as part of a wider shift away from a paradigm where bank finance contributes to a range of intersecting threats to our shared planetary ecosystem, toward a paradigm of financing a just and regenerative economy with ecological and social wellbeing as its core purpose. Moving toward this intersectional approach is the next frontier for banks.

Systems within systems in banking: Finance Innovation Lab, 2022

Total system transformation

The kind of transformation that is needed can feel overwhelming to undertake. Banking can seem like a giant machine – locked in place, impossible to shift. But this is not the case. Bringing about this deep change becomes possible when we recognise that banking is a complex human system, the product of a network of relationships within and between organisations.

From this network of relationships, emerges a set of structures and activities that yield certain results in the world. Focusing on the technical aspects of the change, such as setting targets, risk and impact methodologies, products and policies, is crucial – but insufficient on its own. What is needed alongside instrumental interventions is for banks to transform their sense of purpose and how they organise themselves as complex human systems.

Who can create this change?

Who is in a better position to effect this transformation inside banking, if not those individuals who work within banks themselves? Yes, a range of stakeholders in the banking system at large have important roles to play too, but it is ultimately up to bank employees to enact the changes needed – within themselves and within their organisations.

Intrapreneurs are the flag bearers for transformational change – using storytelling and visioneering to inspire their bank to go beyond incremental adjustments to business as usual, toward deep transformation of its purpose and function. To do this, intrapreneurs need to find clarity for themselves on the big picture of what they are working for, and they most often find this outside their bank.

Inspiring this broader perspective throughout a bank is far from easy. There is a perception within banks that expanding attention onto broader issues will dilute focus, when in reality there is an opportunity to make more substantial progress toward net-zero through an integrated approach as it addresses systemic risks to the bank, strengthening the institution over the long term. But how do we get there? Download Catalysing Bank Climate Action: Lessons from the Inside to find out what we’ve learned about how banking institutions might close the gap between their goals and commitments and where they are today.

Insight: What’s the role of bank employees in helping their banks transition more rapidly?

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This excerpt from the report explores how climate intrapreneurs can play a unique and much-needed role in a bank’s transition from climate being no-one’s job, to someone’s job, to everyone’s job - especially when there isn’t yet a top-down mandate for a bank to transform itself to align with climate goals.

To read this insight in full, download the report using the button at the bottom of the page.

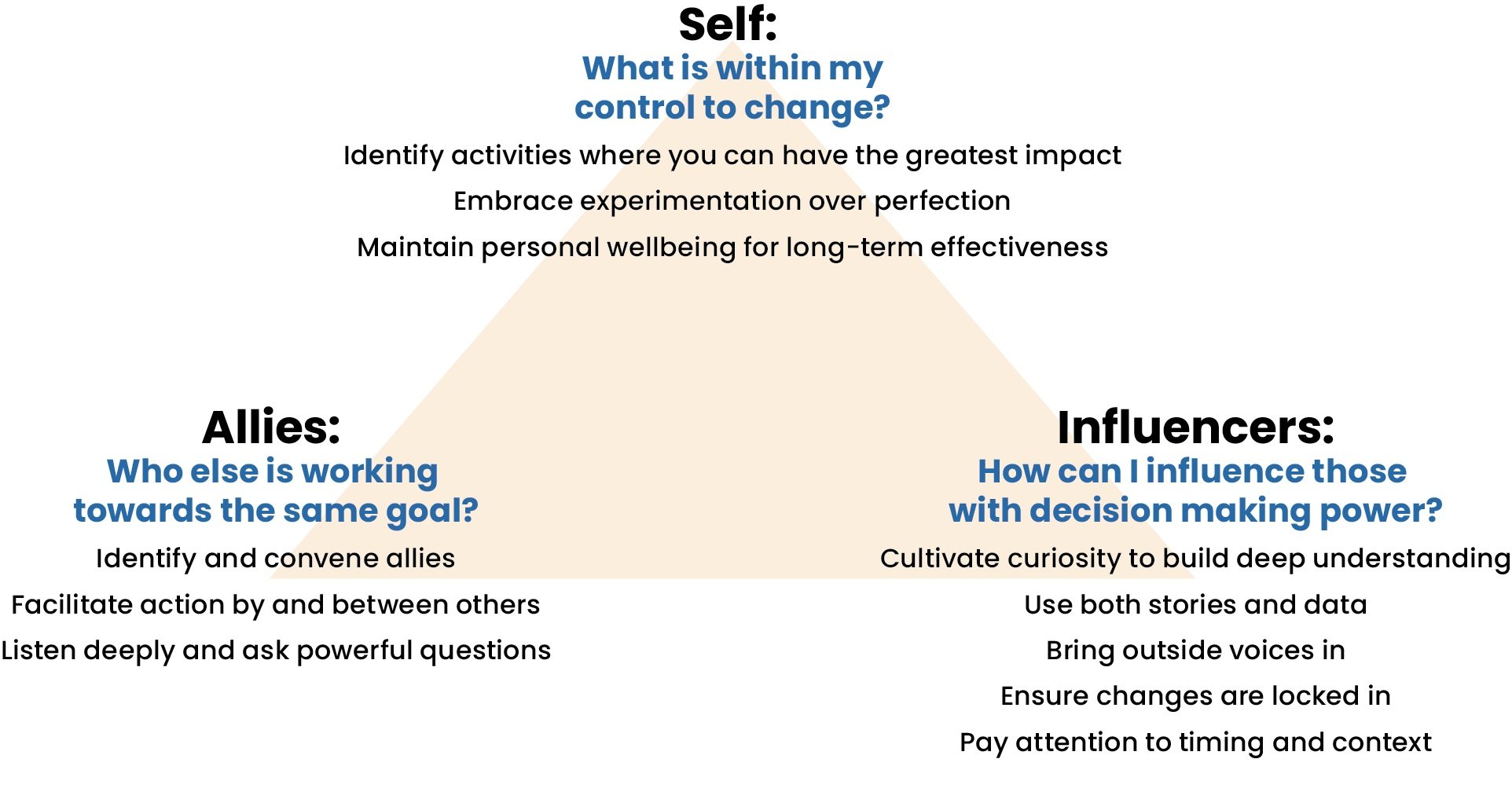

Climate intrapreneurs can be the genesis energy for change

Many Fellows joined our programme eager to gain technical knowledge that would help them take practical action on climate in their banks. As we progressed through the Fellowship, this gave way to a recognition that the knowledge they have is only one piece of the puzzle. Three key themes emerged as important tactics for catalysing transformation from within a bank:

Gain clarity on what is within your control to change

Build collective influence with a network of internal and external allies

Foster the buy-in of decision-makers

Climate intrapreneurship strategies in banks - Finance Innovation Lab, 2022

Self: Gain clarity on what is within your control to change

No single employee has all the knowledge, skills, relationships or time needed to transition a bank on their own. To make the biggest difference with what they do have, it is critical for a climate intrapreneur to identify the most impactful role they can play.

Climate intrapreneurs can gain clarity on the specific role they can play when they:

Identify activities where they can have the greatest impact.

Embrace experimentation over perfection.

Maintain personal wellbeing for long-term effectiveness.

Allies: Build collective influence with a network of allies

Intrapreneurs often feel like they are powerless to make much of a difference on their own, but once they experience themselves as part of a wider movement for a shared goal, change can and does happen.

Climate intrapreneurs can build collective influence through:

Identifying and convening allies.

Facilitating action by and between others.

Listening deeply and asking powerful questions.

Influencers: Foster the buy-in of decision-makers

In established institutions such as banks, decisionmaking about wholesale change tends to sit with those holding formal power. Within banking, many of these formal power-holders tend to have limited time and competing priorities, and so intrapreneurs find themselves asking questions like:

How can I influence colleagues who are senior to me, when I don’t have the experience or expertise that might earn their respect?

I’m several steps removed from the CEO, what can I do to influence their decisions?

Rather than looking at this as a question of power, it can be helpful to see those decisionmakers as holders of responsibility – colleagues who have a duty to make the right decisions.

Top tactics for working with and influencing decision-makers:

Cultivate curiosity to build deep understanding.

Use both stories and data.

Bring outside voices in.

Ensure changes are locked-in.

Pay attention to timing and context.

For full details on exactly how climate intrapreneurs can deploy these tactics, with tangible examples of where CSLN Fellows have had success, download the full report.

Insight: How can climate campaigners & climate intrapreneurs rally for a common goal?

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This excerpt from the report explains how the banking system is much larger than the banking sector alone, and suggests how bank outsiders – campaigners in particular – can play an important role in influencing the scale and pace of change on climate, and in holding banks accountable to it.

To read this insight in full, download the report using the button at the bottom of the page.

A complex web of individuals

We are all part of the banking system – the way it operates affects us all – though our roles are different and the amount of power we have to influence it is not evenly distributed. When the key actors and forces (see image below) work together, we can create the conditions for banks to rapidly transition to meet climate goals.

No single actor can transform banks on their own. But with collective action we can reach a tipping point for change.

Banking system map - Finance Innovation Lab, 2022.

Taking joint action

A large number of NGOs and campaigning groups are focused on influencing banks through one or more of these external levers. This work is vitally important because there are some changes that are very difficult for climate intrapreneurs to make on the inside, without something shifting in their external environment first.

For example, banks have been hesitant to be a first mover on climate in case it makes them less competitive. However, if well-crafted regulation were to require every bank to take action, then sector-wide change could happen very quickly. Until then, we are reliant on voluntary leadership from the institutions that dare to move first, or joint action through industry alliances in a sector with low trust and high competitiveness between banks, plus a strong fear of regulatory repercussions for breaches of competition law.

Campaigners, including individuals and civil society organisations, are demanding banks take science-aligned climate action at sufficient levels of ambition. These campaigners play an important role in building the power of excluded voices in banking, raising reputational risk for banks and motivating various stakeholders to hold banks accountable on their climate progress.

Committed climate activists exist within banks

Because most banks are still moving too slowly on climate, it can appear that those on the inside simply don’t care. What climate intrapreneurs want campaigners to know is that committed climate activists like them exist within banks, and they are working tirelessly to increase the pace and scale of change.

What climate intrapreneurs want from campaigners:

Influence more rigorous regulation.

Target bank decision-makers, in particular boards.

Hold banks accountable to their commitments.

Share expertise to build capacity within banks.

Climate intrapreneurs and campaigners are allies, working for the same goal but playing different roles. If campaigners and intrapreneurs can build relationships of mutual respect, intrapreneurs can help activists gain a more nuanced understanding of banks and what kind of external pressure will be most beneficial in enabling change. In return, campaigners can help intrapreneurs understand where their bank is falling short, and to access the expertise they need to rapidly develop just and regenerative solutions.

For deeper insight and examples of how intrapreneurs can work with external stakeholders to accelerate the climate transition, download the report using the button below.