Case study: ‘Activism’ is not a dirty word

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series. We invited The Sunrise Project, a global campaigning organisation working to hasten the transition from fossil fuels to clean energy, to speak to Fellows on the programme.

Here, Areeba Hamid (Global Finance Programme Director) and Beau O’Sullivan (Senior Communications Officer) share some of their reflections on how climate intrapreneurs and campaigners can accelerate the transition to climate safe banking together.

What did you take away from engaging with intrapreneurs on the Fellowship?

It’s very easy to get lost in the ‘us versus them’ frame, and forget that [bankers] also are human beings with values and have motivations and risk appetites. And all their decisions are based on those factors, like anybody else. So, I think that was quite useful to just break that barrier and speak to the people we are trying to change. It was also quite sobering to hear first-hand that there is still a wide gulf between the level of change that’s needed, and what the Fellows saw as things that can be done by decision-makers internally.

What is The Sunrise Project learning from its work with banks?

“The history of progress is the history of activism in the world”

Following our session with Fellows, we were invited by two Fellows to engage directly with senior leaders in their organisations. Through these conversations, we realised that we have a lot of experience and knowledge that we can impart to those working inside banks, and that these engagements can be very useful. At the same time, there is still a lot of greenwashing in the banking industry – and we play a crucial role in challenging and holding banks accountable. How do we tread that line of being helpful at the same time as holding them accountable? Walking this tightrope is difficult and tense.

Part of our role is to work behind the scenes and support other partners. In our work with media for instance, we help educate journalists about AGM season, how to interpret shareholder resolution results, the types of loopholes in banks’ climate policies, and how to spot good policies announced by banks, etc. Before COP26, we published a short media briefing on how to spot greenwashing by banks which was very successful in framing lots of coverage in the media.

What do you want climate intrapreneurs to know?

A lot of people think that you have no credibility as an activist. This is not true. We have spent hours and hours churning data, learning the Bloomberg terminal, and following the money. And we know how policies with climate risk are developed. Some of the activists we know are the most well-versed people in finance. It’s a mistake to ignore them.

I think that activism is not a dirty word. The history of progress is the history of activism in the world. Activism is about standing up for what you believe in. I’m genuinely interested in hearing about the barriers faced by Sustainability Officers to moving faster and being more ambitious on climate. If banks were more open about barriers and spoke to us, we’d probably be able to find solutions or help in some way. There is also more scope for public policy and government relations teams within banks to step up in their role and act as an activist within. We are keen to work with intrapreneurs to turn up the dial internally – we can do this anonymously, including penning letters to the board or engaging the media.

It’s a leadership challenge. What’s missing are the voices of the leaders. I would love to see leaders of banks break away from the pack. Of course, there are risks with being the first-mover, but that’s what leadership looks like.

Case study: Slowing down in order to speed up

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This Climate Safe Lending Fellow shares how developing their leadership skills is helping them to progress the climate agenda at their bank.

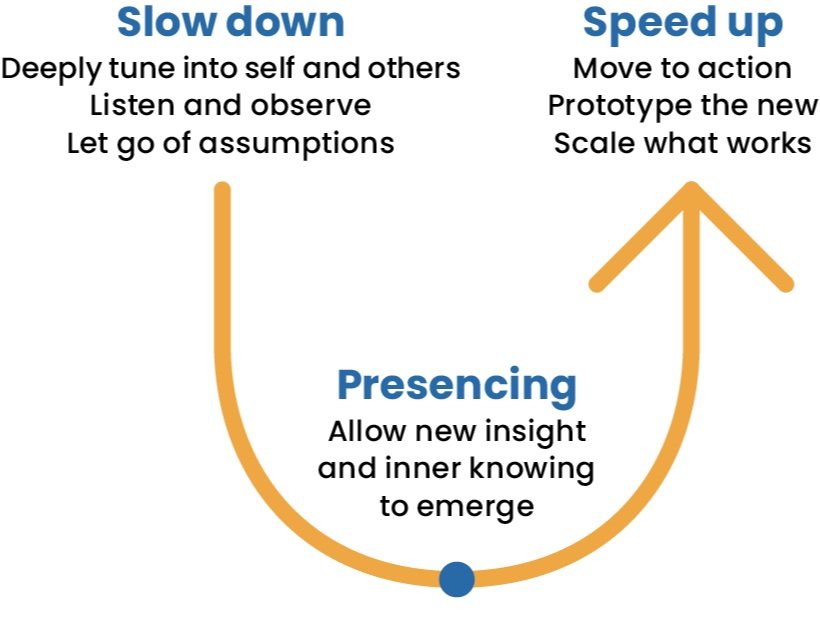

A particular challenge climate intrapreneurs face is difficulty in finding the time and space to do the kind of deep, reflective thinking required to understand complex challenges and develop new solutions amidst the busy, fast-paced world of banking. On the Fellowship, we introduced Otto Sharmer’s Theory U, and the idea of ‘presencing’, which encouraged Fellows to actively make the time to slow down and let new insight emerge in order to be more effective.

One Fellow described how this approach is helping them:

Adapted from Theory U

“In peer coaching yesterday, the topic we worked through was feeling we don’t have capacity to do everything we need to do. I was too embarrassed to propose it, but I was feeling it, so I’m glad someone else did. It’s a massive challenge! Theory U is my biggest takeaway. I usually go straight to action because I feel that’s my only choice. Spending just a minute or two working down the ‘U’ and up the other side is a very powerful mental model for me.

“I now have a ‘U’ on a whiteboard which helps me to slow down – it’s a mental reminder. Anything I need to make a strategic decision on and feel I have no time to work on, I sit down, look at the U, spend some time being present and really think through all the options. I then spend the time at the bottom of the U to let new insight emerge and take fast action from there. Doing that has really helped me to clear out the backlog on some things, and stopped me missing out on other things.

“If we can’t do this, we’ll burn out. I don’t want to do that, I love my job way too much.”

CSL Fellow 21/22

Case study: Building buy-in with the Executive team

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series. This Climate Safe Lending Fellow shares how developing their leadership skills is helping them to progress the climate agenda at their bank.

Business has the power to make change

“A lot has happened during the time I’ve been on the Fellowship – some of these things might have happened anyway, they were in-flight pre-Fellowship, but they wouldn’t have been nearly as successful without the learnings from the Fellowship. I can say that with a great deal of confidence.

“I’ve been able to talk about ESG and climate change for an hour in front of our leadership team – that’s a huge allocation of time with that group of people. A year ago, if I had been given 15 minutes with our CEO I would have hit him with facts and stats and been disappointed with the results. The Fellowship has changed all of that. I had the opportunity to talk to 90 senior people. While I couldn’t completely get away from facts, I focused on emotional cases which was very different for me. I made them feel uncomfortable and it was kind of scary. I told them that business has the power to make change. I used an analogy with cars: they are the leaders who sit behind the steering wheel powered by the motor of business. I asked, “where are you going to take us?” I tried to make them think and understand they are the ones who have the ability to make change.

We are no longer debating that green business is good business.

“We have a centuries-long corporate history; the thought of losing that legacy if we fail to adapt has been a strong motivator.”

“On the heels of the above, we had a project team present a big eight-month project on green business. A series of concrete, discrete and directional recommendations were shared with the Executive team. Our CEO remarked that green business and climate will be the next frontier for us. His leadership in turn gave direction to the rest of our leaders – these are serious, strategic business issues. The biggest challenge now is implementation. But we are no longer debating that green business is good business.

ESG now has a seat at the table

“I think what is most importantly ‘mine to own’, is to bring climate initiatives forth confidently, firmly, unapologetically. Sometimes it feels that we lead with “we know you have a lot going on, but we need to focus on this too.” I’m working on shifting this to, “This is the lens through which we need to view our business, if we fail to do so, we risk losing business”. We have a centuries-long corporate history; the thought of losing that legacy if we fail to adapt has been a strong motivator. What’s different has been my ability to change the way we go about discussing these issues in a direct, more forceful way.

“ESG now has a seat at the leadership table. I’m pushing for us to go beyond green and sustainability, getting to the core of my Critical Shift which focuses on a just, equitable and sustainable approach to business. If I hadn’t taken the time to think about my Critical Shift, or if I’d backed off on the loftiness of it, we wouldn’t be in the position right now to propose this approach at the bank. Hopefully, we are on the verge of some transformative transitions in our organisation, and that is really quite exciting.”