Insight: What kind of banking system is fit for a just and regenerative economy?

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This excerpt from the report explores what kind of a banking system is fit for a just and regenerative economy. To read in full, download the report using the button at the bottom of the page.

People are planet

Many in the Western world are just now remembering what indigenous cultures have known all along – that people are planet. The problem is (particularly in Western culture) we’ve developed an assumption of ourselves as separate from nature, and have structured societies and economies accordingly. This mindset has led us to shortsightedly use our creative human faculties to serve our own species at the expense of the living and non-living world we depend on to sustain us.

If we can agree that, at its most fundamental, a healthy planetary ecosystem that can sustain life indefinitely is necessary for human existence; and if we can agree that individuals and communities meeting their own needs ultimately benefits our ability to meet our own – then we can begin to explore why we have banks and what we need them to do.

Why do we have banks?

Today, we can identify five immediate functions served by the banking system: creating money, channelling money, looking after other people’s money, sharing risk, and maintaining transaction and settlement systems.

But in the end, what do we need these functions for? Ultimately, banking as a system should create, deploy and facilitate the use of money for the purpose of enabling us to meet our needs as individuals, communities and societies. The banking system should be judged not only on how efficient it is at turning money into more money, but also on how well it plays its unique part in enabling a thriving planetary ecosystem and the human societies within it.

How well are banks meeting this purpose?

Zooming in on the challenge of human-induced climate breakdown, it is clear that banks on the whole are not delivering on this ultimate purpose. The finance that a bank makes available determines the kinds of activities that take place in our economies. Despite a wave of net-zero commitments from banks, their financing for carbon emitting activities has grown over the past five years: In 2021 alone, the world’s 60 largest private sector banks provided $742 billion in finance to fossil fuels.

Yet carbon emissions do not sit in isolation from other ways the planetary ecosystem (human and non-human) is in trouble – and bank finance influences them all. Focusing only on net-zero emissions is short-sighted. We and our Fellows see what is commonly named the ‘climate agenda’ as part of a wider shift away from a paradigm where bank finance contributes to a range of intersecting threats to our shared planetary ecosystem, toward a paradigm of financing a just and regenerative economy with ecological and social wellbeing as its core purpose. Moving toward this intersectional approach is the next frontier for banks.

Systems within systems in banking: Finance Innovation Lab, 2022

Total system transformation

The kind of transformation that is needed can feel overwhelming to undertake. Banking can seem like a giant machine – locked in place, impossible to shift. But this is not the case. Bringing about this deep change becomes possible when we recognise that banking is a complex human system, the product of a network of relationships within and between organisations.

From this network of relationships, emerges a set of structures and activities that yield certain results in the world. Focusing on the technical aspects of the change, such as setting targets, risk and impact methodologies, products and policies, is crucial – but insufficient on its own. What is needed alongside instrumental interventions is for banks to transform their sense of purpose and how they organise themselves as complex human systems.

Who can create this change?

Who is in a better position to effect this transformation inside banking, if not those individuals who work within banks themselves? Yes, a range of stakeholders in the banking system at large have important roles to play too, but it is ultimately up to bank employees to enact the changes needed – within themselves and within their organisations.

Intrapreneurs are the flag bearers for transformational change – using storytelling and visioneering to inspire their bank to go beyond incremental adjustments to business as usual, toward deep transformation of its purpose and function. To do this, intrapreneurs need to find clarity for themselves on the big picture of what they are working for, and they most often find this outside their bank.

Inspiring this broader perspective throughout a bank is far from easy. There is a perception within banks that expanding attention onto broader issues will dilute focus, when in reality there is an opportunity to make more substantial progress toward net-zero through an integrated approach as it addresses systemic risks to the bank, strengthening the institution over the long term. But how do we get there? Download Catalysing Bank Climate Action: Lessons from the Inside to find out what we’ve learned about how banking institutions might close the gap between their goals and commitments and where they are today.

Insight: What’s the role of bank employees in helping their banks transition more rapidly?

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This excerpt from the report explores how climate intrapreneurs can play a unique and much-needed role in a bank’s transition from climate being no-one’s job, to someone’s job, to everyone’s job - especially when there isn’t yet a top-down mandate for a bank to transform itself to align with climate goals.

To read this insight in full, download the report using the button at the bottom of the page.

Climate intrapreneurs can be the genesis energy for change

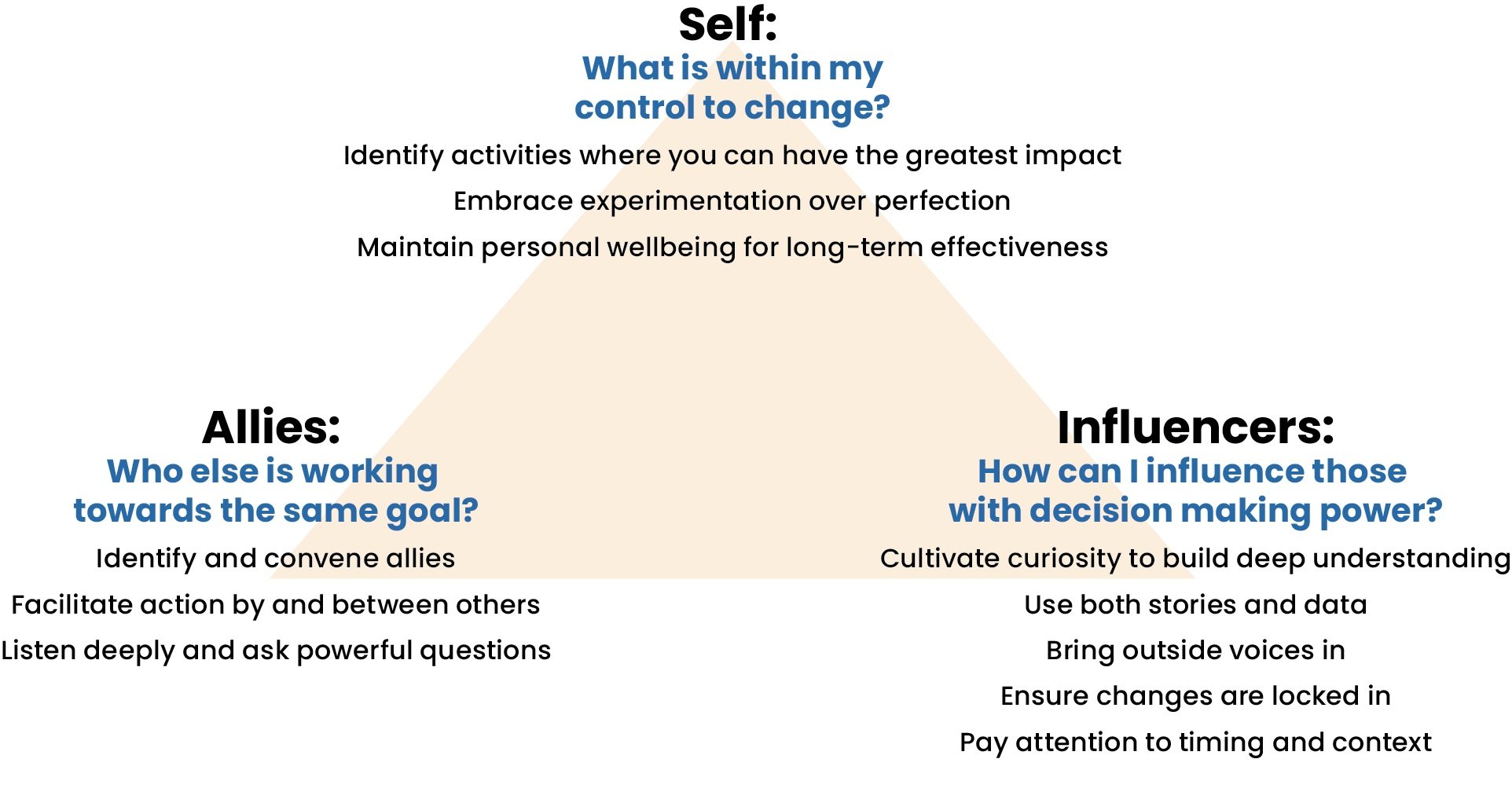

Many Fellows joined our programme eager to gain technical knowledge that would help them take practical action on climate in their banks. As we progressed through the Fellowship, this gave way to a recognition that the knowledge they have is only one piece of the puzzle. Three key themes emerged as important tactics for catalysing transformation from within a bank:

Gain clarity on what is within your control to change

Build collective influence with a network of internal and external allies

Foster the buy-in of decision-makers

Climate intrapreneurship strategies in banks - Finance Innovation Lab, 2022

Self: Gain clarity on what is within your control to change

No single employee has all the knowledge, skills, relationships or time needed to transition a bank on their own. To make the biggest difference with what they do have, it is critical for a climate intrapreneur to identify the most impactful role they can play.

Climate intrapreneurs can gain clarity on the specific role they can play when they:

Identify activities where they can have the greatest impact.

Embrace experimentation over perfection.

Maintain personal wellbeing for long-term effectiveness.

Allies: Build collective influence with a network of allies

Intrapreneurs often feel like they are powerless to make much of a difference on their own, but once they experience themselves as part of a wider movement for a shared goal, change can and does happen.

Climate intrapreneurs can build collective influence through:

Identifying and convening allies.

Facilitating action by and between others.

Listening deeply and asking powerful questions.

Influencers: Foster the buy-in of decision-makers

In established institutions such as banks, decisionmaking about wholesale change tends to sit with those holding formal power. Within banking, many of these formal power-holders tend to have limited time and competing priorities, and so intrapreneurs find themselves asking questions like:

How can I influence colleagues who are senior to me, when I don’t have the experience or expertise that might earn their respect?

I’m several steps removed from the CEO, what can I do to influence their decisions?

Rather than looking at this as a question of power, it can be helpful to see those decisionmakers as holders of responsibility – colleagues who have a duty to make the right decisions.

Top tactics for working with and influencing decision-makers:

Cultivate curiosity to build deep understanding.

Use both stories and data.

Bring outside voices in.

Ensure changes are locked-in.

Pay attention to timing and context.

For full details on exactly how climate intrapreneurs can deploy these tactics, with tangible examples of where CSLN Fellows have had success, download the full report.

Insight: How can climate campaigners & climate intrapreneurs rally for a common goal?

As part of the publication of the brand new Catalysing Bank Climate Action: Lessons from the Inside report, we share key insights, lessons and anonymised case studies in this blog series.

This excerpt from the report explains how the banking system is much larger than the banking sector alone, and suggests how bank outsiders – campaigners in particular – can play an important role in influencing the scale and pace of change on climate, and in holding banks accountable to it.

To read this insight in full, download the report using the button at the bottom of the page.

A complex web of individuals

We are all part of the banking system – the way it operates affects us all – though our roles are different and the amount of power we have to influence it is not evenly distributed. When the key actors and forces (see image below) work together, we can create the conditions for banks to rapidly transition to meet climate goals.

No single actor can transform banks on their own. But with collective action we can reach a tipping point for change.

Banking system map - Finance Innovation Lab, 2022.

Taking joint action

A large number of NGOs and campaigning groups are focused on influencing banks through one or more of these external levers. This work is vitally important because there are some changes that are very difficult for climate intrapreneurs to make on the inside, without something shifting in their external environment first.

For example, banks have been hesitant to be a first mover on climate in case it makes them less competitive. However, if well-crafted regulation were to require every bank to take action, then sector-wide change could happen very quickly. Until then, we are reliant on voluntary leadership from the institutions that dare to move first, or joint action through industry alliances in a sector with low trust and high competitiveness between banks, plus a strong fear of regulatory repercussions for breaches of competition law.

Campaigners, including individuals and civil society organisations, are demanding banks take science-aligned climate action at sufficient levels of ambition. These campaigners play an important role in building the power of excluded voices in banking, raising reputational risk for banks and motivating various stakeholders to hold banks accountable on their climate progress.

Committed climate activists exist within banks

Because most banks are still moving too slowly on climate, it can appear that those on the inside simply don’t care. What climate intrapreneurs want campaigners to know is that committed climate activists like them exist within banks, and they are working tirelessly to increase the pace and scale of change.

What climate intrapreneurs want from campaigners:

Influence more rigorous regulation.

Target bank decision-makers, in particular boards.

Hold banks accountable to their commitments.

Share expertise to build capacity within banks.

Climate intrapreneurs and campaigners are allies, working for the same goal but playing different roles. If campaigners and intrapreneurs can build relationships of mutual respect, intrapreneurs can help activists gain a more nuanced understanding of banks and what kind of external pressure will be most beneficial in enabling change. In return, campaigners can help intrapreneurs understand where their bank is falling short, and to access the expertise they need to rapidly develop just and regenerative solutions.

For deeper insight and examples of how intrapreneurs can work with external stakeholders to accelerate the climate transition, download the report using the button below.